July 6, 2024

As we look forward to Meta Stock Predictions 2025, financial backers and examiners are intently checking Meta Stages, Inc. (previously Facebook, Inc.) for experiences in the organization’s stock presentation. With the continuous development of the computerized scene and Meta’s essential drives, the stock expectations for the impending year are a subject of critical interest.

Meta Stock Predictions 2025 (Meta Platforms Inc):

- Average Price: Meta Platforms Inc (META) is expected to reach an average price of $755.01 in 2025.

- High Prediction: The highest prediction for META’s stock price in 2025 is $968.01.

- Low Estimate: The lowest estimate for META’s stock price in 2025 is $542.02.

Current Market Position

As of mid-2024, Meta has been exploring a complicated climate, set apart by the two open doors and difficulties. The organization has confronted administrative investigation, security concerns, and contests from arising online entertainment and tech stages. Regardless of these obstacles, Meta’s stock has shown flexibility, supported by its hearty publicity income and ceaseless advancement in innovation.

Key Drivers for Meta Stock Predictions 2025

1. Metaverse Development:

Meta’s aggressive vision for the Metaverse is supposed to be a significant development driver. The organization is putting vigorous effort into expanding reality (AR) and computer-generated reality (VR) advances. By 2025, these speculations are expected to begin yielding significant returns as shopper and venture reception increments.

2. Artificial Knowledge and Machine Learning:

Simulated intelligence and AI are at the center of Meta’s procedure to upgrade client experience and further develop promotion, focusing on. Propels here could prompt better commitment on Meta’s foundation, possibly driving up client development and publicizing income.

3. Regulatory Environment:

While administrative difficulties persevere, how Meta explores these will be pivotal. The result of progressing fights in court and new guidelines could altogether affect the organization’s activities and benefit.

4. Expansion in Arising Markets:

Meta keeps on extending its impression in developing business sectors where web entry is developing. Outcomes in these districts could prompt another flood of client development and income broadening.

Table of Contents

Examiner Projections

Examiners have blended conclusions from Meta’s stock standpoint for 2025. Bullish examiners highlight the organization’s mechanical heads and the capability of the Metaverse to make new income streams. They anticipate Meta’s stock arriving at new levels on the off chance that these endeavors succeed. A few forecasts recommend the stock could see a 15-20% expansion from its ongoing levels, driven by areas of strength and vital execution.

Alternately, more careful investigators feature the administrative dangers and contests as huge headwinds. They contend that except if Meta actually addresses these difficulties, its stock could encounter instability. These experts foresee a more safe development rate, assessing a 5–10% increment in stock worth.

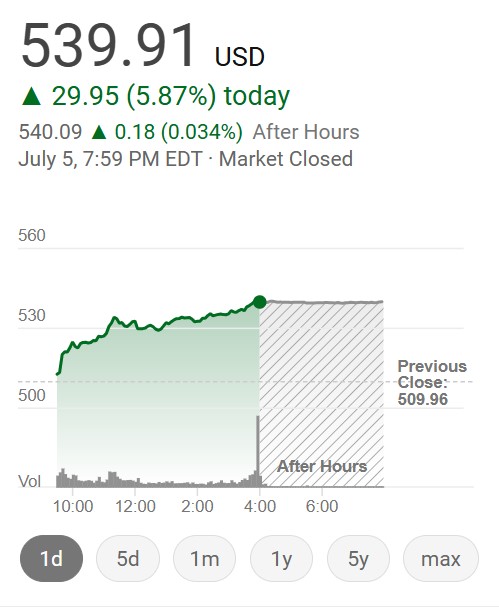

instant of Meta Stock Predictions 2025 lets explore the historical stock prices for Meta Platforms Inc. (formerly known as Facebook). Here’s a summary of the stock’s performance over the past year:

- July 3, 2024: The closing price was $509.96 with an adjusted close of the same value. The trading volume was 6,005,600 shares.

- June 4, 2024: The stock opened at $506.37, reached a high of $511.28, and closed at $509.96. The trading volume on that day was 6,005,600 shares.

End

Meta’s stock expectations for 2025 are molded by a mix of mechanical development, vital ventures, and outside challenges. While the organization’s striking endeavors into new domains like the Metaverse present invigorating open doors, administrative and serious tensions can’t be ignored. Financial backers should intently screen Meta’s headway on these fronts to settle on informed choices.

As 2025 methodologies, Meta’s process will without a doubt be one of the most firmly watched in the tech area, with its stock exhibition filling in as a gauge for more extensive industry patterns.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.