Nvidia’s Stock Price: A Comprehensive Analysis Post Stock Split

Santa Clara, California – In the ever-evolving landscape of technology stocks, Nvidia Corporation (NVDA) stands out as a beacon of innovation and growth. The recent 10-for-1 stock split has brought renewed attention to this tech giant, prompting analysts and investors alike to speculate on the future trajectory of its shares.

The Stock Split: A Closer Look

Goldman Sachs has urged caution to those expecting a sustained rally following Nvidia’s stock split. Historical trends suggest that such splits have minimal long-term impact on share prices and market liquidity. Despite this, Nvidia’s stock has experienced a significant surge post-split, climbing from a split-adjusted $15 to nearly $121.

Nvidia’s Market Dominance

Founded in 1993, Nvidia has cemented its reputation as a leading supplier of graphics processing units (GPUs), application programming interfaces (APIs) for data science, high-performance computing, and system-on-a-chip units (SoCs) for mobile computing and automotive markets.

GPUs: The Heart of Visual Computing

Nvidia’s GPUs are at the forefront of visual computing, powering everything from consumer video editing and 3D rendering to PC gaming. The GeForce line remains popular among consumers, while professional GPUs like Quadro and NVIDIA RTX are essential tools in architecture, engineering, media, entertainment, and scientific research.

AI: The Frontier of Innovation

Nvidia’s influence extends into the realm of artificial intelligence (AI), where its hardware and software solutions are critical for AI training and inference. Applications in deep learning, computer vision, and natural language processing all rely on the power of Nvidia’s GPUs.

Beyond Gaming: Diverse Applications

Nvidia’s reach goes beyond gaming into data center computing platforms, networking solutions, and cloud-based visual computing. The CUDA software platform is instrumental in creating massively parallel programs that utilize GPUs for supercomputing tasks globally.

Automotive and Metaverse Ventures

In the automotive sector, Nvidia drives innovation with platforms that power infotainment systems and autonomous features. Additionally, the company is at the cutting edge of metaverse and 3D internet application development.

Stock Performance and Future Projections

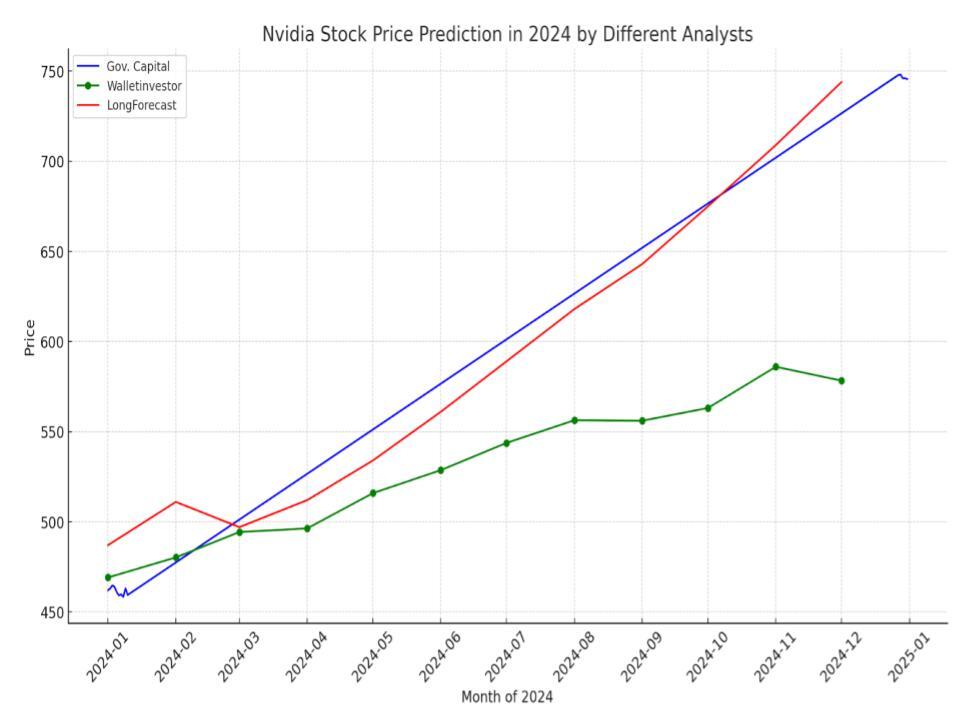

Currently priced at approximately $121.79, Nvidia’s stock reflects the company’s significant growth over the years. Analysts offer varied predictions for its future:

- 12-Month Forecast: A consensus among 43 Wall Street equity research analysts sets the average twelve-month stock price forecast for Nvidia at $115.21, with a high estimate of $150.00 and a low estimate of $47.50.

- Next 30 Days: The short-term outlook is optimistic, with an average analyst price target of $1330.60—a substantial increase from the current price.

- Long-Term Forecast: Some analysts have raised their price targets for Nvidia, suggesting potential growth to $1,450.

These projections underscore the diverse opinions on Nvidia’s future performance but collectively point towards a positive outlook for this tech powerhouse.

Conclusion

As Nvidia continues to innovate and expand its influence across various sectors, its stock remains a focal point for investors seeking growth in the technology sector. While past performance is not indicative of future results, Nvidia’s track record suggests that it is well-positioned to maintain its status as a key player in the market.

This comprehensive analysis provides insight into Nvidia’s recent stock split and its implications for investors while highlighting the company’s robust product offerings and market performance.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.